Hassle Free Company Liquidation

Process in Dubai & UAE

You took the decision, now we take care of Liquidation process without much Financial & Mental Stress.

Company Liquidation Process in Dubai

Company liquidation, overseen by the Department of Economic Development (DED) in Dubai, UAE, involves the winding up of a company, ceasing its operations, and distributing its assets to creditors and shareholders.

An effective liquidation process not only ensures legal compliance and avoids unnecessary penalties but also maximizes asset value, safeguards the company’s

reputation, and can provide closure for stakeholders.

2 Types of Company Liquidation Process in Dubai / UAE

Liquidation, commonly known as winding up, is a formal process where a company s

operations cease, its assets are sold, and the proceeds are used to pay off the company’s

liabilities. In the UAE, there are primarily two types of company liquidation processes. Let’s delve deeper into each one.

Voluntary Liquidation

Voluntary liquidation is instigated by the decision-makers of the company, namely the owners or shareholders. Unlike a situation where a company is forced to liquidate, in voluntary liquidation, the company chooses to undergo this process for various reasons.

The individuals who have been at the helm of the company might decide to retire and not hand over the business to someone else. Liquidation becomes a chosen path in such circumstances.

The company might want to change its operational structure or merge with another entity. The existing entity might undergo voluntary liquidation to pave the way for a new business model or merger.

Sometimes, despite the business being solvent, the decision-makers might deem that the business is no longer viable due to market changes, technological

evolution, or other external factors.

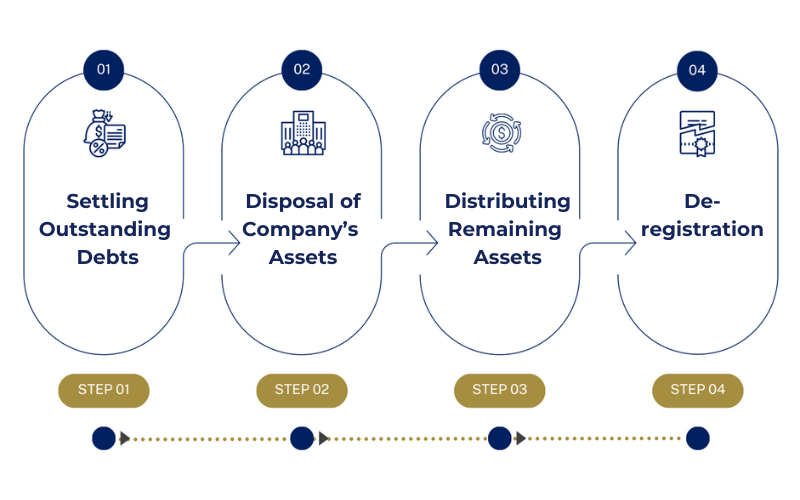

Process Of Voluntary Liquidation

Compulsory Liquidation

As opposed to voluntary liquidation, compulsory liquidation isn’t a choice. It s a dire situation forced upon the company by external entities:

The primary reason for compulsory liquidation is the company s inability to pay off its debts. A company is considered insolvent when its liabilities exceed its assets or it s unable to pay its debts as they come due.

Creditors, fearing they might not get their money back due to the company s poor

financial health, might push for liquidation. Similarly, regulatory authorities could

order a wind-up if they find any malpractices or violations that could harm the

public or the economy.

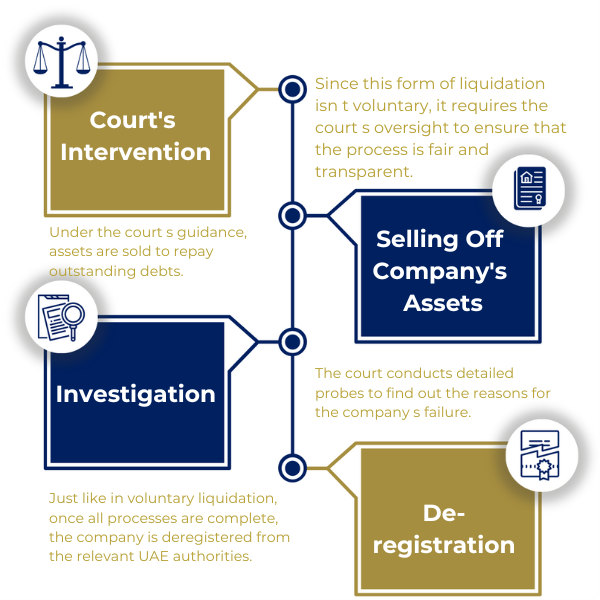

Process Of Compulsory Liquidation

Documents required for Company

Liquidation in Dubai

-

Board Resolution

-

Liquidation Letter

-

No Liability Certificates

-

Visa Cancellation Evidence

-

Original Trade License

-

Share Certificates

-

Labour Establishment Card

-

Clearance from Government Departments

FREQUENTLY ASKED QUESTIONS

The time taken to liquidate a company in the UAE can vary based on factors like the complexity of the company's financial affairs and the efficiency of the liquidation process, but generally, it can take anywhere from a few weeks to several months.

Legal requirements for liquidating a company in the UAE include a board resolution or shareholder resolution for liquidation, appointing a liquidator, publishing a liquidation notice in two local newspapers, and obtaining clearance certificates from various government bodies.

During a company's liquidation in the UAE, employees' rights are protected. They are entitled to receive end-of-service benefits and any outstanding wages, and these payments are given priority over other claims.

Yes, a foreign-owned company can be liquidated in the UAE. However, the process may be different depending on the specific circumstances of the company and the legal structure under which it operates.

Assets of a company in liquidation in the UAE are utilized to settle its debts. Any remaining assets after all debts and liquidation costs are cleared are then distributed among shareholders.

Penalties for not properly liquidating a company in the UAE can include fines, restrictions on starting a new business, and potential legal implications related to unresolved liabilities and commitments.

The cost of liquidating a company in the UAE can range from AED 5,000 to AED 20,000 or more, including liquidator's fees, deregistration fees, and the costs of publishing liquidation notices in newspapers.

While a company's debts can be written off during liquidation in the UAE, it is subject to the company's assets' availability, the hierarchy of claims, and the liquidator's assessment.

Liquidation refers to the process of settling all the affairs of a company, paying off its debts, and distributing its assets, leading to its dissolution. Dissolution, however, is the final step where the company ceases to exist legally after liquidation.

A company can avoid liquidation in the UAE by addressing financial difficulties promptly, restructuring its debts, negotiating with creditors, or seeking new investment or merger opportunities.

Directors' personal liability is usually limited in a company liquidation unless there's evidence of wrongful trading or fraudulent behaviour. They may also face restrictions on managing other companies in the UAE.

A company in liquidation in the UAE is typically not permitted to continue regular business operations. Its activities are limited to those necessary to conclude the liquidation process.

When a company is liquidated in the UAE, its contracts are typically terminated, subject to the terms of those contracts. Certain contractual obligations may continue to apply during the liquidation process.

Reviving a company after liquidation in the UAE is not usually possible as liquidation is a final process resulting in the company's dissolution.

To liquidate a Free Zone company in the UAE, you must follow the specific regulations of the relevant Free Zone Authority, which typically involves appointing a liquidator, settling all obligations, and cancelling the company's license and visas.

Let's Setup Your

Company In Dubai.

Get in touch Today!

We offer tailored solutions to help your business from pre-setup to growth