Setup Your Freezone Company

in Dubai

It’s not an easy task to choose the right free zone for your Business when you have 50+ Free zone locations. But we can help you choose the Right Free zone for you based on your Business activity.

Start Your UAE Free Zone Company Today!

Company Formation in any one of the UAE’s 50+ freezones is a complicated process, with various factors to consider, from location to business types, cost, and regulatory requirements. Our Company formation Expert simplifies the process, guiding you through every decision and ensuring that it aligns with your specific business needs. We don’t just save you money, we make the setup experience effortless and efficient, providing personalized solutions to meet your business objectives.

Choose VR1 Global for a personalized, professional, and proactive approach to business setup. With us, you’re not just starting a business, you’re building a successful venture in the UAE’s vibrant marketplace.

Freezone Company in Dubai or UAE

100% Foreign Ownership

Enjoy complete control over your business without local ownership restrictions.

100% of your profits

Move all your earnings back to your home country without any hindrances.

World Class Knowledge

Leverage unrestricted access to top notch expertise and resources.

0% Income Tax

Keep your earnings intact with no obligation to pay income tax.

Business Friendly License

Hassle free licensing procedures, for your ease and convenience.

Steps to Setup Freezone Company in Dubai

Starting a Freezone company is a breeze with our assistance. Your journey begins with a one on one chat with our specialist who will clarify all the details and help you prepare your required documents. This ensures a stress free process and leaves no room for mistakes.

Once everything is in order, you’ll receive your Freezone license marking the official start of your venture.

The last step is setting up your Corporate bank account, which we will guide you through. Throughout this process, our team provides you with clear and simple guidance, making each step easier and your Freezone company setup effortless.

Business Activity

General Trading to Manufacturing, you have endless options. Our Company Formation expert will help you choose the perfect Business activity that suits your Business & also the UAE Laws.

Broadcasting

This involves overseeing radio, TV, and web streaming operations.

Education and Training

These services involve various educational and training activities.

Film, Production and Post-Production

This involves licensing for activities like film.

Event Management

Organizing various events like conferences, and production etc.

Entertainment

This pertains to music production, recording, promotion, rights management.

Marketing Services

This involves diverse activities such as advertising, PR, research, and more.

IT Services

IT services encompass a variety of activities in the technology sector, including e commerce.

Consultancy

This involves offering advice in fields such as business, lifestyle, investment, legal, and human resources.

Industrial

Manufacturing and raw goods processing, with warehousing.

New Media

Photography, web design, and digital media services like mobile app creation.

Publishing

Directories, guides, books, magazines, requiring special authority approval.

Trading

This involves conducting import or export related transactions.

tells a lot about your Business

General Trading to Manufacturing, you have endless options. Our Company Formation expert will help you choose the perfect Business activity that suits your Business & also the UAE Laws.

Steps to Setup Freezone Company in Dubai

Industrial License

An Industrial License is granted to companies that will engage in manufacturing or industrial activities. It covers businesses that convert natural resources into final products.

Service License

Issued to service oriented businesses, professionals, artisans, and craftsmen. This license allows individuals or companies to provide their professional expertise and skills based services within the UAE.

Trade License

Issued by the Department of Economic Development (DED) in Dubai, permits businesses to engage in trading activities like buying, selling, or trading of goods and commodities.

Manufacturing License

For companies operating in the manufacturing sector. For businesses located in free zones and having at least 51% GCC ownership, and can distribute their products in the UAE.

Cost of Setting up Your

Freezone Company

The exact cost of setting up your Freezone Company can vary

on multiple factors, but our Company formation experts can

provide you the Best packages based on your Business

Activity.

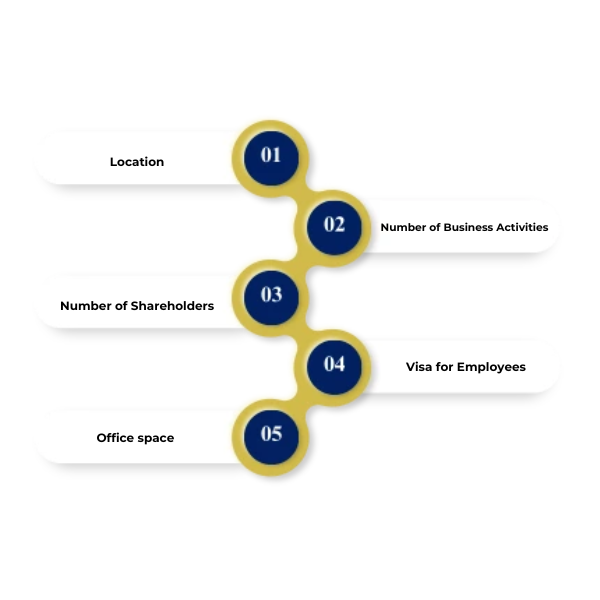

Price Breakdown for Freezone Company

Every Business is Unique and we offer tailored packages to each company based on your requirements. Here are some of the guiding factors for final cost of Freezone Company Formation.

Freezone Company Registration in Dubai

We have simplified the company registration process for you, so that you can focus on growing your Company. Checkout our Step by step procedure.

FREQUENTLY ASKED QUESTIONS

Setting up a Freezone company in Dubai can cost from AED 15,000 to over AED 50,000, depending on the Freezone and the nature of the business.

Freezone companies can do business outside the UAE and in the Freezone itself, but require a local agent to trade within the mainland of Dubai.

The Sharjah Media City Freezone (SHAMS) is often considered the cheapest Freezone for company setup in the UAE. Get in touch to know more about Freezone company formation in Dubai.

A Freezone company typically consists of one or more shareholders (individuals or corporations), a director, and a secretary.

Freezone companies generally do not pay income or corporate tax in the UAE as they trade outside the Freezone companies.

Benefits of working in a Freezone include 100% foreign ownership, no import or export taxes, and minimal bureaucratic regulations.

Yes, a Freezone company can open a bank account in Dubai, which is a fundamental step for business operations. This process involves submitting the required documents, which typically include a corporate kit and personal identification documents of the company's shareholders and directors, to the chosen bank.

A Freezone visa in Dubai is usually valid for 2 years. After the 2-year period, the visa can typically be renewed, given the business is still operational and the visa holder continues to meet the required conditions.

A Freezone company can rent an office within the Freezone itself, but for an office outside the Freezone, a local agent or distributor is needed.

Sure, you can lease an office on the mainland in Dubai even if your business has a free zone license. But, you'll need a special permission letter known as a No Objection Certificate (NOC) from the free zone authority.

According to the UAE Corporate Tax Law, a person or entity qualified under the Free Zone ("Qualifying Free Zone Person" or "QFZP") is subject to different tax rates: They will not be taxed (0% tax rate) on qualifying income, while a tax rate of 9% applies to any taxable income that doesn't fall under qualifying income.

Yes, a Freezone company can sell online in the UAE. However, to do so, they may need to obtain an E-commerce license, a special permit that legally allows a company to sell products or services over the internet. Additionally, these companies must abide by all relevant regulations and laws governing online commerce in the UAE, which could include rules around data protection, digital tax compliance, and consumer rights, among others.

Freezone companies that are registered in Dubai have the capability to purchase property, but only in designated freehold areas and under specific rules. However, it's important to note that Freezone companies registered in other emirates of the UAE are generally not permitted to buy property in Dubai. Thus, while Dubai Freezone companies do have some property ownership rights, these are subject to particular conditions and restrictions.

To cancel a Freezone visa, you need to apply to the immigration department in the relevant Freezone with the required documents and fees.

Each free zone in Dubai is overseen by its respective Free Zone Authority (FZA), such as the Jebel Ali Free Zone Authority (JAFZA) or the Dubai Airport Free Zone Authority (DAFZA). These authorities are responsible for issuing operating licenses and assisting businesses in setting up within their designated Free Zones.

Workers employed in Free Zones typically fall under the jurisdiction of their respective Free Zone Authority's employment law, rather than the broader UAE Labour Law. This means that the rules and working conditions for employees are determined by the specific Free Zone Authority, making it essential for both employers and employees to understand and adhere to these unique regulations.

Free zone visas in Dubai have a set validity period, which is clearly indicated on the visa itself. Even if an individual has an 'unlimited' employment contract, the associated employment visa still comes with an expiration date, which essentially makes the visa 'limited' in its duration.

Let's Setup Your

Company In Dubai.

Get in touch Today!

We offer tailored solutions to help your business from pre-setup to growth